Financing and Budgeting Advice for Prefab Homes

Home » Financing and Budgeting Advice for Prefab Homes

Financing and budgeting advice for prefab homes is essential, ensuring a smooth and cost-efficient building process.

Dreaming about a new home is one of the most thrilling experiences, yet the financial aspect can be daunting.

For those considering the contemporary path of prefab homes in Ontario, the decision-making process requires a comprehensive understanding of financing options and prudent budgeting strategies.

Cost savings and financing options of prefab homes can be readily understood through diligent research.

This article is designed to serve as a guiding light through the labyrinth of financial jargon and budgetary quandaries.

Ensuring that your prefab home vision becomes a sturdy reality is within your reach!

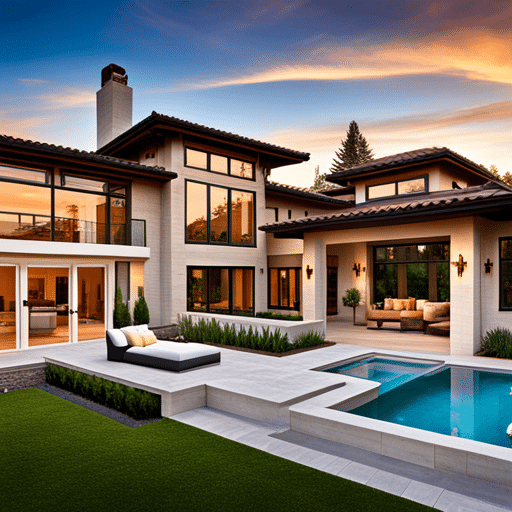

As a quick depiction, our own prefab homes Ontario collection offers budget-friendly and customizable designs, coupled with eco-friendly advantages!

Understanding Prefabricated Homes

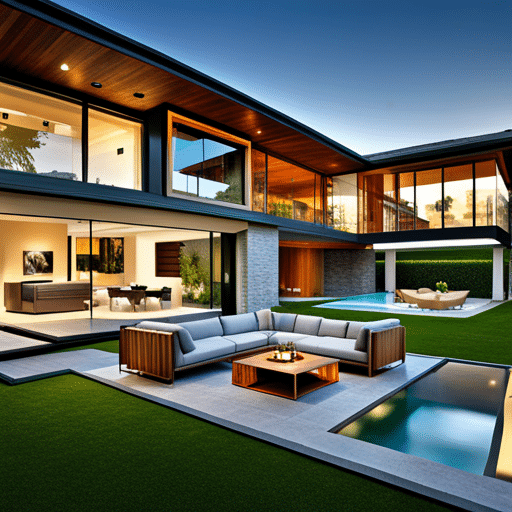

The rise of prefabricated homes, or “prefabs,” in Ontario is an architectural revolution.

These are homes that are manufactured off-site and assembled on-location, offering several advantages over traditional stick-built ones.

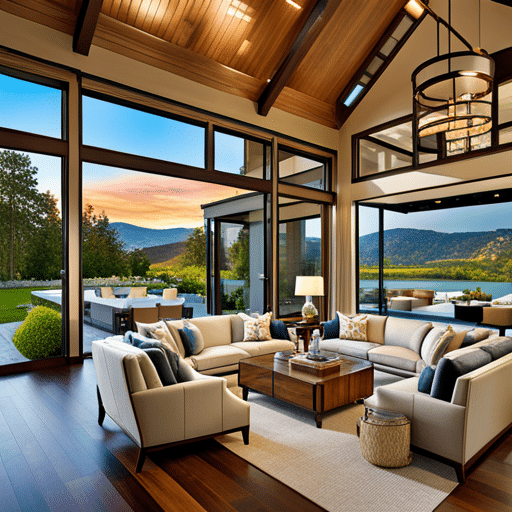

Prefabricated homes often combine cost-effectiveness, customizability, and eco-friendliness, making them an attractive option for modern homebuyers.

The Financial Commitment of Prefabricated Homes

Purchasing a prefabricated home is an investment in your future.

Like any investment, it demands careful financial planning.

The initial cost is just the tip of the iceberg; there are several financial aspects to consider, such as land acquisition, permits, and utilities hookup costs.

Financing Options for Prefabricated Homes

When it comes to financing a prefab home, options are as varied as the designs themselves.

Understanding the nuances of each can make a significant difference in overall costs.

Traditional Mortgages

Most financial institutions offer mortgages for prefabricated homes which are subject to the same eligibility criteria as traditional homes.

This may be one of the simplest and most common ways to secure financing.

Specialized Loans

Some lenders may offer specialized loans tailored to prefabricated homes.

These can have specific conditions such as lower down payments or quicker approval times.

Construction Loans

In scenarios where you’re buying the prefab as part of a construction project, a construction loan can help you manage the various expenses that crop up through the build process.

Home Equity Line of Credit (HELOC)

Those who already own a home have the option of leveraging their equity through a HELOC to finance their prefab home.

The Financial Blueprint of Prefab Homes

Financial stalwarts assert that education and preparedness are the cornerstones of any sizable investment.

Given the uniqueness of prefab homes versus traditional builds, understanding the distinct financing options available is paramount.

Laying the Groundwork: Budgeting for a Prefab Home

Crafting a realistic budget is the initial step.

Beyond the cost of the prefab unit itself, there are the expenses of land acquisition, site preparation, utilities, and the often-forgotten, soft costs—permits, taxes, and insurance.

Create a detailed budget plan that aligns with the total project scope to prevent future financial hiccups.

Traditional Mortgages vs. Chattel Mortgages

The most common query is often about the type of loan suitable for prefab homes.

Traditional mortgages are prevalent for prospective homeowners seeking financing for prefab homes.

However, chattel mortgages, often used to finance personal property like mobile homes, are also an option for prefabs, as they are placed on a leasehold estate or personal property.

Prefab-Specific Financing

Several financial institutions offer loans tailored to the prefab market.

These loans can be the key to unlocking the security you need for your prefab purchase.

Local credit unions, like the Ontario Teachers’ Credit Union, and national banks, such as the Royal Bank of Canada, are increasingly recognizing the demand for housing innovation.

In fact, these institutions are now providing specialized prefab financing options.

Ontario's Demand for Prefab Homes

Navigating through Ontario’s real estate regulations and financial market can be intricate.

However, the province’s love for cutting-edge technology and sustainability dovetails beautifully with prefab housing.

Provincial Grants and Incentives

Ontario presents multiple financial incentives to promote energy efficiency and sustainable housing, like the Green Ontario Fund.

Homebuyers of prefabricated residences can leverage these funds, effectively reducing their financial load and catalyzing green initiatives.

Understanding the Land Situation

Securing land for a prefab home can differ from buying land for a traditional build.

Land with access to municipal services and roadways may be pricier but will streamline setup and ongoing living.

Be well-versed in Ontario’s land development regulations and plan accordingly.

Next Steps After Financing

Once the financial pieces fall into place, it’s time to move onto the next steps.

Whether you’re customizing your prefab home, finalizing contracts with the manufacturer, or coordinating delivery and assembly, remember that transparency is crucial.

Ensure all agreements are clear, and responsibilities are well-delineated among all parties involved.

Be sure to include builders and financiers in this transparency.

This clarity will pave the way for a more seamless and enjoyable prefab homeownership experience.

Preparing Your Prefab Home Financing Application

Eligibility for prefab home financing mirrors that of traditional home loans.

However, there are nuances, such as the need for the prefab to comply with local building codes and standards.

Here are some tips to fortify your application:

Credit Health

A good credit score and history can drastically improve your financing prospects.

Prior to applying, review your credit report to identify and resolve any discrepancies or issues.

Organize Your Finances

Lenders will scrutinize your financial health.

Make sure to have all relevant documentation, including income statements, employment history, and tax returns.

This will allow you to present a comprehensive financial profile.

Property Appraisal

For prefab financing, property appraisals occur post-construction.

The lender will assess not only the prefab’s value but also the land and related expenses.

Seek Professional Help

A seasoned real estate lawyer or financial advisor can provide valuable insight.

They will ensure your rights and interests are protected throughout the financing process.

Leveraging Financial Tools to Make Prefab Dreams a Reality

Financial Incentives and Rebates

There are various federal and provincial incentives in Canada for eco-friendly homebuyers.

These can help to alleviate the financial burden and make the transition to a prefab home more enticing.

Understanding Your Financing Options

Before even exploring prefab homes, it’s crucial to understand your financing options.

Traditional mortgage loans can often be adapted to prefab housing, or specific loans designed for prefabs can offer unique terms and benefits.

National and Provincial Grants

Canada has a robust system of grants and incentives for homeowners, with a number specifically targeting prefab homes.

The Canadian Mortgage and Housing Corporation (CMHC), for example, offers grants for eco-friendly home features, which many prefab homes excel in.

Provinces may also offer their own additional grants.

Knowing what’s available in your area can significantly reduce the cost of your prefab purchase.

Tax Incentives for Eco-Friendly Homes

In Canada, you can also leverage tax incentives for energy-efficient homes.

Prefab homes are often designed with sustainable features that could qualify you for rebates or lower your overall tax burden.

This will make your investment not only environmentally friendly but fiscally responsible as well.

Builder and Manufacturer Rebates

Many prefab home companies also offer their own financial incentives.

This may include rebates on the purchase price.

It may even mean credits towards customizations and upgrades.

These can be significant bonuses that slash your overall home cost.

Incentives and Rebates Available for Prefab Home Buyers

The Green Ontario Fund

The Green Ontario Fund offers a number of incentives for those looking to reduce their carbon footprint.

These include rebates for installing energy-efficient light fixtures, upgrading insulation, and purchasing energy-efficient appliances.

This will enhance your prefab home’s environmental profile and your pocketbook.

First-Time Home Buyers Tax Credit

First-time home buyers in Ontario can benefit from this tax credit, which offers a significant rebate on your land transfer tax.

In some cases, this can make a substantial dent in your overall home acquisition expenses when purchasing a modular home.

Home Energy Conservation Program (HECP)

The Home Energy Conservation Program provides various rebates designed to lower your energy bills and contribute to a greener home environment.

By attending an energy audit and implementing recommended upgrades that many prefab homes are built to exceed, you could be eligible for substantial rebates.

The Nitty-Gritty of Prefab Home Financing

Successfully securing financing for your prefab home requires careful planning and solid financial preparation.

You’ll need to consider factors like credit scores, a substantial down payment, and any upfront costs associated with the prefab purchasing process.

Planning Your Prefab Home Investment Strategically

Seeking Professional Financial Advice

No two homebuyers’ financial situations are the same, so it’s always wise to seek professional advice.

A mortgage broker or financial planner can offer personalized guidance and help you take advantage of all available incentives and financing tools.

Researching and Applying for Financial Incentives

Understanding the financial landscape and being proactive about seeking out incentives can be a game-changer.

Keep up to date with any new grants or rebates that may be introduced and apply for them early to maximize your benefits.

Be Prepared for Extra Costs

While prefab homes often represent cost savings compared to traditional builds, extra costs can still add up.

Be prepared for expenses such as land preparation, permits, and moving and installation fees that may not be included in the base home price.

The Verdict on Prefab Homes and Funding Boosts

With their growing popularity and the increasing availability of financial incentives, prefab homes in Canada are an alluring choice for prospective home buyers.

By thoroughly researching your options, understanding the incentives available to you, and planning your purchase strategically, you will have a solid plan going forward.

You can turn your prefab dream into a financially sound and rewarding reality.

Prefabricated homes are, without a doubt, revolutionizing the Canadian housing market.

They represent not only a new way of thinking about home construction but also an innovative approach to financing.

With the right financial strategy in place, home buyers can find themselves not just homeowners but also pioneers in the eco-friendly, efficient housing movement.

If you’re considering the jump to prefab, the time has never been better.

With financial tools and incentives evolving alongside the housing market, modular homes are proving to be a financial and architectural innovation worth exploring.

Budgeting for Your Prefabricated Home

Creating a well-thought-out budget is the keystones of successfully financing your prefab home.

It requires a meticulous consideration of every potential expense and over budgeting to accommodate surprises.

Initial Purchase Costs

The prefab itself is often a significant portion of the budget.

Factors that influence this cost include size, design complexity, materials, and additional customizations.

Site Development and Preparation

Before the home can be placed on your property, there are a variety of site development costs to cover, such as land clearing, excavation, and laying the foundation.

Infrastructure and Utilities

In addition to the home itself, you’ll need to ensure your property is equipped with water, power, and sewage.

This may require costly connections, especially in remote areas.

Permits and Paperwork

Navigating the legal requirements and obtaining the necessary permits can often be an overlooked but expensive aspect of building a prefab home.

Contingency Planning

Always set aside a percentage of your budget for unexpected costs.

It’s not a question of ‘if’ but ‘when’ unforeseen expenses will arise.

The Role of Timing in Your Prefab Home Purchase

Timing can heavily influence the costs of your prefab home project.

For instance, building during the off-peak seasons may save you money on labor and certain materials.

Sourcing Materials and Labor

The cost of raw materials and labor fluctuates with market conditions.

Smart scheduling can help you procure them at the best prices.

Seasonal Factors

Different seasons can affect construction timelines.

Winter, for instance, might delay your project due to weather conditions, while summer could see increased costs due to high demand.

The Final Steps Before You Build

Before you start building, there are several final financial steps to address.

This includes:

- Finalizing your loan or mortgage.

- Ensuring the construction contract includes all necessary details.

- Securing insurance coverage.

Finalizing Your Financing

With the various financing options available, it’s important to thoroughly review and choose the option that best suits your circumstances.

This choice can have significant long-term financial implications.

Construction Contract

The contract with your prefab manufacturer and construction company should detail costs, deliverables, and timelines.

Legal or financial advice can be invaluable before you sign this document.

Insurance Coverage

Ensuring your prefab home is appropriately insured from the moment work begins can protect you from financial loss due to theft, vandalism, natural disasters, or other unfortunate events.

Long-Term Financial Considerations

Budgeting for a prefab home isn’t just about the immediate costs.

It’s also about planning for the future and ensuring your new home is a sustainable investment.

Resale and Appreciation

Consider how your prefab home’s value may change over time and what you can do to increase or maintain that value.

Maintenance and Upkeep

Creating a fund for ongoing maintenance and potential upgrades is an often-overlooked but crucial part of your prefab home’s financial planning.

Energy Efficiency and Savings

Making your prefab home as energy efficient as possible can lead to significant long-term savings on utility bills, effectively paying off the investment in the home’s eco-friendly features.

Local Financial Climate

Keep an eye on local economic conditions and real estate markets, as they can influence your prefab home’s value and financing options.

Financing and Budgeting Advice for Prefab Homes

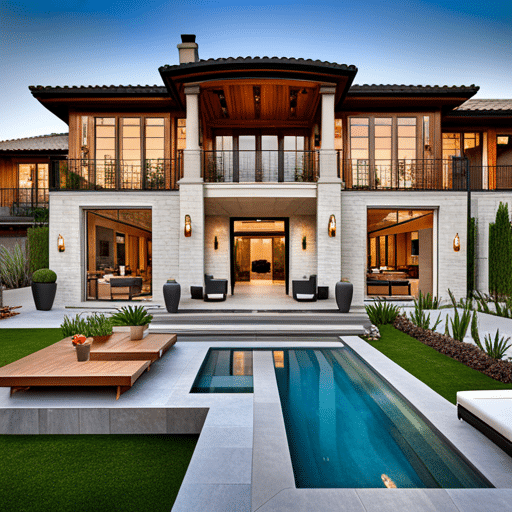

Budgeting and financing a prefab home in Ontario will require a proactive, thorough approach.

By understanding the financing options available, creating a meticulous budget, and accounting for long-term financial implications, you can ensure that your prefab home is a smart financial decision.

A sound and sustainable investment that aligns with your future goals is always paramount.

If you’re considering a prefabricated home in Ontario, don’t hesitate to seek advice from financial planners, real estate professionals, and other experts to guide you through this exciting process.

With the right financial approach, your prefab home can be the embodiment of practicality and innovation.

Get Affordable Prefab Homes in Ontario: Contact us Today!

With our Modern and Affordable Prefab Homes in Ontario, we pride ourselves on delivering exceptional customer service!

We ensure a seamless purchasing and installation process for your dream home.

Our team is dedicated to meeting your unique needs and transforming your vision into a beautiful reality.

To start your journey of building a prefab home in Ontario, we invite you to get in touch with us at My Own Cottage.

You can reach out to us through our website’s Contact Us page, via email, or by direct phone call.

Our expert team is ready to listen to your vision, discuss your requirements, and guide you through the stress-free process of prefab home construction.

We look forward to partnering with you to create a sustainable, highly valuable, and personalized space that reflects your individual style and meets your specific needs.

Contact us today and let’s embark on this exciting journey together.

Thanks for reading!

If you’re interested in building a prefab home, cabin or cottage on a lot of your own, feel free to book a no-obligation consultation with us here at My Own Cottage Inc. – and get started on your dream home today!

P.S: Or if you prefer, you can simply fill out the form below!